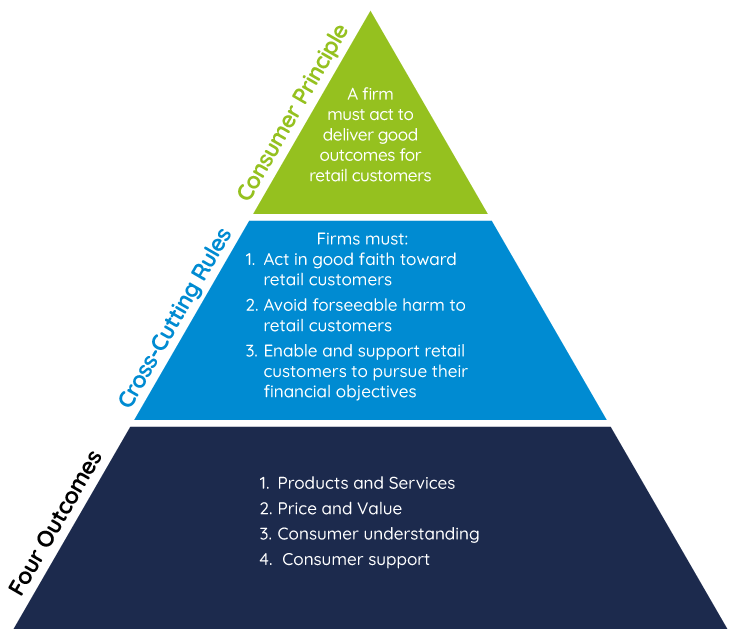

The Consumer Duty is a crucial part of the FCA's ongoing endeavours to strengthen consumer protection in the financial services sector. Consumer Duty encompasses a core principle that mandates firms to take actions that deliver good outcomes for retail customers. It also prescribes expected behaviours that financial firms must demonstrate to ensure they prioritise the best interests of their customers.

The Consumer Duty emphasises the importance of customer outcomes, and Options UK Personal Pensions LLP, as a leading provider of self-invested pensions, absolutely embraces this principle. We view the Duty as aligned with our values and commitment to prioritising our customers’ needs in delivering positive results.

Following the issuance of the final Consumer Duty rules by the FCA, our primary focus has been on identifying the required adjustments and enhancements across the four outcomes of the duty:

- Products and Services

- Price and Value

- Consumer Understanding

- Consumer Support

In conjunction with our ground up approach and a firmly established and resilient methodology for product development and governance, we will consistently evaluate the fair value of our offerings in accordance with the client target market and client needs. We endeavour to ensure we establish a strong culture in our organisation that is aimed towards providing excellent customer service, ensuring our customers are able to understand their chosen product, thereby reducing future consumer harm.

Our continual assessments of the Consumer Duty regulatory requirements will enable us to deliver exceptional results and support to our customers and advisers by continually improving our governance, frameworks and strategy.

In this section we provide information useful for our distributors to comply with Consumer Duty, enabling them to understand our products, target market and be able to assess their own distribution processes.

Fair Value Assessment and Target Market Statements: